Could a PRS rental crisis be on the way?

New research from the Rental Landlords Association (RLA) shows that a growing number of landlords are planning to sell their Buy-to-Let properties in the next 12 months. This suggests the current housing crisis, where there just aren't enough affordable homes of every tenure, could get even worse.

These latest survey results highlight that PRS investors and landlords remain uncertain about the backdrop which governs the rules and regulations they must adhere to, as a landlord. Of course, some of the newer rules that have recently been brought in are there to support tenant’s rights. But some have also worked to make it more expensive to become a BTL landlord and also, less profitable.

RLA survey findings

The latest RLA State of the PRS survey, for the second quarter of 2019, shows a number of details indicating more landlords plan to sell at least one property in the next 12 months, as their confidence is declining.

Specifically, 51.6% of survey respondents said they were less confident or much less confident about their ability to achieve their objectives as a landlord, than three months earlier.

Looking at the past 12 months:

- 67.8% of landlords said their portfolio was unchanged.

- 8.6% bought one property.

- 4.6% bought two or more properties.

- 12% of respondents sold 1 property.

- 5.7% sold two or more properties.

Then, looking ahead to plans for the coming 12 months:

- 46.5% of landlords said they plan to keep their portfolio size the same.

- 8% said they plan to buy two or more properties.

- 4.7% said they plan to buy one property.

- 21.6% of respondents said they plan to sell one of their BTL properties.

- 9.1% of landlords said they planned to sell two or more of the portfolio.

Those figures show that almost one third of landlords who responded to the RLA’s Q2 survey said they plan to sell at least one property in the next 12 months, with just 12.7% planning to buy at least one property over the same period. The proportion of landlords planning to sell in the next year is more than double the proportion who have already sold at least one portfolio property in the past 12 months.

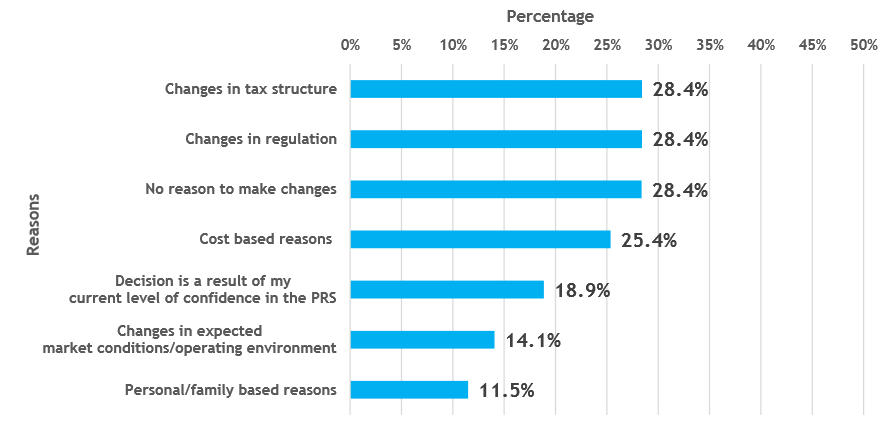

The survey also asked why landlords were planning to sell up, with the following answers:

“The proportion of landlords who have either sold or are planning to sell property is increasing. This is a worrying signal for those concerned about the supply of homes available to rent privately,” the RLA said in its report. “Tax and regulation change feature strongly in the decision-making process, underpinning key landlord decisions. There is also strong evidence that a substantial proportion of landlords value their relationship with tenants highly enough so that they hold rents on an annual basis.”

Rental demand remains high

The survey also questioned landlords on their perceptions of tenant demand. Given that a rising proportion of respondents said they plan to sell up in the next 12 months, you might be surprised to hear that overall, demand was considered to be the same or stronger by the majority of landlords.

- 41.3% of landlords said they hadn’t noticed any significant change in tenant demand.

- 15.4% of landlords said rental demand had decreased.

- 24.8% of respondents said demand had risen.

With demand mainly considered to be good or higher than previously, it seems that even despite the taxation changes, remaining on the PRS sector as a BTL landlord, or even expanding your portfolio could prove a good move.

Of course, as an investor you should always consider the risks and as rents rise, so to the risks that tenants could miss payments or default. But, that’s only true of a small proportion of tenants and there are ways to protect yourself against that and using a rent guarantor is one of them.

Requesting your tenants use a rent guarantor, either a close family member or friend, or through a service like Rent Guarantor, will help protect our rental income and ensure your return on investment is protected.

Of course, each landlord is different and their investment decisions are influenced by a variety of things. That means that sometimes, selling up or at least reducing your PRS portfolio is the right thing to do. Hopefully though, that’s not true for every landlord, or the current housing crisis really could get a whole lot worse.